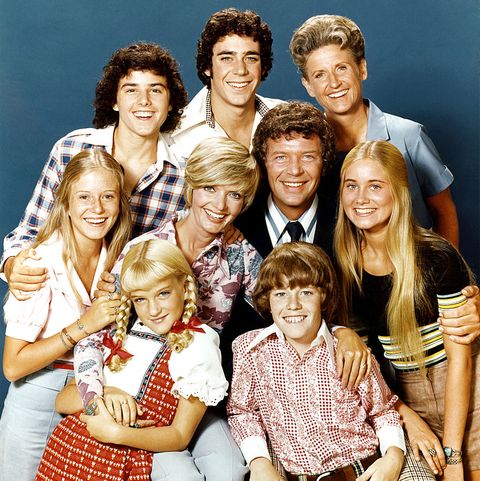

Here’s the story…. of Why Estate Planning is Essential for Blended Families

When The Brady Bunch aired in the 70s, it showed a fairly idyllic representation of a blended family, with only the first season discussing the awkward adjustments and possible rivalries of bringing together two already-existent families. Even when such problems were shown, they were inevitably solved and wrapped up with a bow before the end […]

Unpacking the Proposed Estate Tax Changes

In the past few weeks, it’s likely that you’ve seen attention-grabbing headlines like these: Wealthy may face up to 61% tax rate on inherited wealth under Biden planBiden’s estate tax changes will wipe out millions of small businesses. With lots of dialogue surrounding President Biden’s proposed changes, it’s worth taking a moment to unpack and understand what […]

There Should Be Nothing Cryptic About Cryptocurrency In An Estate Plan

Cryptocurrencies have a more prominent role in estate planning than they did a decade ago. Since Bitcoin was introduced 12 years ago, cryptocurrencies have steadily grown in acceptance. A recent survey showed that 10% of people in the United States now own some form of cryptocurrency. Additionally, a 2020 online survey by the Cremation Institute […]

Death and Taxes

Death and Taxes are two certainties in life. When they collide, the results can be disastrous without careful consideration and planning. The good news is that most inheritances are passed on free of tax. However, a misstep could cost you dearly with the IRS depending on the size of the estate and the type of […]

Prop 19 – the Good, the Bad and the Ugly

Prop 19 passed with a very narrow margin in California and is bringing major changes to property tax assessment rules. There are some good things about the changes for a select group of people. However, there are major changes to parent to child or grandparent to grandchild transfers that used to be exempt from property tax reassessment. I’ll cover the good news first, then the bad news and then what can be done now before Prop 19 goes into effect.

How Prop 19 Changes Parent to Child Transfers

Under Prop 19, the parent to child reassessment exclusion no longer applies unless it is a transfer of a primary residence from a parent to a child who uses it in turn as their primary residence. Whereas before there was no limit to the value of the transfer of a primary residence, prop 19 only excludes the first $1 million of assessed value.

Talk to Your Family over the Holidays about Your Estate Plan

Many of us labor a lifetime to build up our assets and fight for causes that matter to us. Few things are more fulfilling than the thought of sharing wealth and legacy with our family.

Of course, it’s impossible to plan for every eventuality, but careful planning can mitigate against the two primary risks.

Why you need an estate plan. Now.

Amazingly, 6 in 10 U.S. adults don’t have a will or living trust, and almost half of boomers (age 53-71) haven’t put their estate planning documents in place yet. In my experience, I have seen that most people fail to set up an estate plan because they simply don’t know they need one. Estate planning isn’t just for the wealthy, every adult needs some level of estate planning regardless of their age or how many assets they have. In fact, if you don’t create your own estate plan, then you are on the default plan that the State of California has in place for you (and you probably won’t like it).

The 5 Golden Rules of Lending Money to Children

When you think about the price of having kids, the costs that come to mind may include things like child care, camp, braces and college tuition.What probably doesn’t spring to mind are mortgages, car payments or personal loans.

Who Will Inherit Your Financial Wisdom?

Many people who inherit wealth or small businesses are at significant risk for essentially squandering the wealth. An Ohio University study shows that an astonishing 33 percent1 of all beneficiaries lose their entire inheritance within two years of receiving it. The ways they manage to do so are as varied as the imagination, but in our experience we have seen a common thread: mismanagement.