Biden’s Budget Bill (and it how it might apply to you)

Recent headlines have been dominated by discourse surrounding Biden’s proposed $3.5 Trillion “Build Back Better” plan, and the recent negotiations looking to trim it. Here’s a quick update on where those negotiations stand, and how the bill may affect you. When first proposed, the $3.5 trillion plan sought to (among other expenses) fund universal preschool, […]

What Does a Trustee Do Anyway?

If a loved one asks you to act as a trustee of their trust, it is because they trust you to be able to handle their affairs in their place. They believe you can exercise strong, fair, and independent judgement when necessary. Although the position of trustee can be a whirlwind of responsibilities and duties, […]

What Californians Need to Know About the Oregon Estate Tax

Of all the states, Oregon has (rightfully) earned a reputation for having one of the most complex and far reaching estate tax structures. Any individual who owns property in Oregon, (even if they have never been a resident of the state!) may unexpectedly be subject to an estate tax at death. Here, we’ll break down […]

What Britney Spears has to do with your Estate Planning

In recent weeks, music icon Britney Spears has been dominating headlines as more and more details about her legal conservatorship have come to light. In her emotional court hearing a few weeks ago, Britney spoke out about the abusive nature of the legal arrangement, describing how every detail of her life一from her social media posts […]

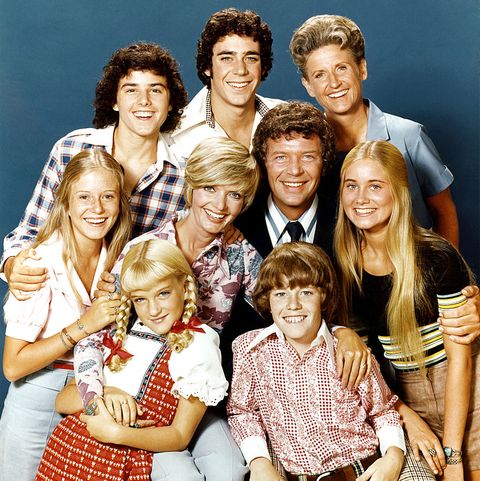

Here’s the story…. of Why Estate Planning is Essential for Blended Families

When The Brady Bunch aired in the 70s, it showed a fairly idyllic representation of a blended family, with only the first season discussing the awkward adjustments and possible rivalries of bringing together two already-existent families. Even when such problems were shown, they were inevitably solved and wrapped up with a bow before the end […]

Unpacking the Proposed Estate Tax Changes

In the past few weeks, it’s likely that you’ve seen attention-grabbing headlines like these: Wealthy may face up to 61% tax rate on inherited wealth under Biden planBiden’s estate tax changes will wipe out millions of small businesses. With lots of dialogue surrounding President Biden’s proposed changes, it’s worth taking a moment to unpack and understand what […]

There Should Be Nothing Cryptic About Cryptocurrency In An Estate Plan

Cryptocurrencies have a more prominent role in estate planning than they did a decade ago. Since Bitcoin was introduced 12 years ago, cryptocurrencies have steadily grown in acceptance. A recent survey showed that 10% of people in the United States now own some form of cryptocurrency. Additionally, a 2020 online survey by the Cremation Institute […]

Death and Taxes

Death and Taxes are two certainties in life. When they collide, the results can be disastrous without careful consideration and planning. The good news is that most inheritances are passed on free of tax. However, a misstep could cost you dearly with the IRS depending on the size of the estate and the type of […]

Prop 19 – the Good, the Bad and the Ugly

Prop 19 passed with a very narrow margin in California and is bringing major changes to property tax assessment rules. There are some good things about the changes for a select group of people. However, there are major changes to parent to child or grandparent to grandchild transfers that used to be exempt from property tax reassessment. I’ll cover the good news first, then the bad news and then what can be done now before Prop 19 goes into effect.

How Prop 19 Changes Parent to Child Transfers

Under Prop 19, the parent to child reassessment exclusion no longer applies unless it is a transfer of a primary residence from a parent to a child who uses it in turn as their primary residence. Whereas before there was no limit to the value of the transfer of a primary residence, prop 19 only excludes the first $1 million of assessed value.