Click on the image above to hear Paul Newman discuss the benefits of gifting appreciated stock to charity rather than cash. If you gift appreciated stock directly to charity, you can claim the full fair market value of your stock as a charitable deduction. If the stock is liquidated prior to gifting to charity, you will have to pay capital gains tax on the liquidation of the stock.

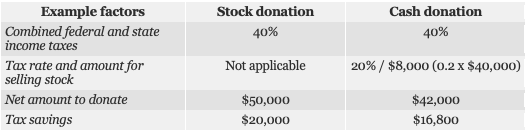

Here’s an example:

Suppose you can either (1) donate $50,000 in stock held more than one year or (2) sell the stock first and donate the proceeds. The stock has a cost basis of $10,000. You have a 40% combined federal and state tax rate on your income and a combined 20% tax rate on capital gains.

As you can see, the tax savings with this strategy can be significant. If you have any questions about this strategy, please don’t hesitate to contact me or talk to your trusted tax advisor.